Income tax

Increase in child tax bonus

Since January 2023, there has been an increase in the tax bonus again. Instead of the originally approved amount, the tax bonus is increased as follows:

- 140 euros for children under 18 years old (originally it was supposed to be 100 euros for children under 15 years old)

- 50 euros for children from 18 years of age (originally it was supposed to be 50 euros for children from 15 years old)

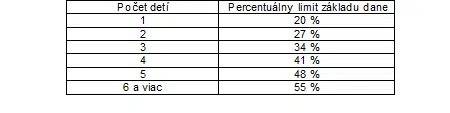

However, it will be possible to claim a tax bonus only up to a specified percentage of the income tax base, depending on the number of dependent children.

Thus, the amount of the tax bonus for an employee or self-employed person continues to depend on the number of children and the amount of the tax base, considering as the tax base income reduced by contributions to the Social and Health Insurance Companies. Thus, not every taxpayer will receive the maximum amount of the tax bonus.

Lifting of the registration requirement

With the arrival of the New Year, the registration obligation of taxpayers to income tax is abolished in some cases, due to the fact that it will be carried out by the tax office ex officio.

These are cases where a natural person establishes a trade or a legal entity is registered in the Commercial Register. The tax administrator has this information available from the trade or business register and performs the registration for income tax himself.

Those entrepreneurs who conduct business on the basis of special regulations (lawyers, auditors, tax advisors, experts, interpreters, translators, notaries), i.e. they are not registered in the trade register, and further those entrepreneurs who rent real estate, will still have to register for income tax.

Value added tax

Abolition of the obligation to register for exempted transactions

According to the rules in force from the New Year, those entrepreneurs who supply only exempt insurance or financial services or supply only VAT-exempt real estate will no longer have to register for VAT.

Such entrepreneurs currently have to register for VAT after exceeding the turnover of EUR 49,790 for 12 consecutive calendar months, filing zero VAT returns, as they have no right to deduct VAT.

As of 1 January 2023, such entrepreneurs no longer need to register for VAT and submit zero VAT returns. At the same time, such entrepreneurs who are already registered for VAT can apply for the cancellation of the VAT registration.

Obligation to refund VAT in case of non-payment of an invoice

From 1 January 2023, a new obligation for VAT payers in respect of unpaid invoices is introduced. If the customer does not pay the invoice to his Slovak supplier in whole or in part, and 100 days have elapsed since the due date of this invoice, he will have to return to the state all or an aliquot part of the VAT that he claimed on the received invoice.

VAT refund obligation for theft of small property

According to the current wording of the law, a business entity must reimburse VAT on small movable property if they were stolen from him in the year of acquisition and at the same time deducted VAT when buying them, while in the case of stolen depreciated assets, he must return a proportion of the VAT until the asset is fully depreciated.

According to the new wording of the law, a business entity must reimburse VAT on small movable items stolen from it, not only in the year of their purchase, but until the fictitious depreciation period expires. For example, if an entrepreneur bought a computer worth less than 1,000 euros for the performance of his business, included this computer fully in the cost of the year of acquisition, deducting VAT on the purchase, and the computer is stolen from him for the third year, he must return an aliquot part of the VAT to the state in the year of theft, since the computer is normally depreciated for four years.

Information obligation for payment service providers

In the context of the rise of cross-border e-commerce, a new obligation is being introduced for payment service providers, which are mainly banks. From January 2024, banks will be required to keep records and inform tax authorities in each Member State about payments made to different sellers across the European Union.

Thus, individual financial reports within the European Union will have sufficient tools, through the central European payment system, to control and detect such transactions, unless acknowledged by individual sellers. The obtained data on payments received will be subjected to risk analyses, cross-checking and subsequent evaluation by the tax authorities, on the basis of which tax audits can be targeted.

VAT rate reduction

Sport-related services and restaurant and catering services will be subject to a reduced VAT rate of 10% from the New Year. According to the original wording of the amendment to the VAT Act, the reduced VAT rate was to apply only for a transitional period until the end of March 2023, but at the last minute there was a permanent reduction in the VAT rate for sports and gastrosector transactions.

Tax code

Failure to impose a fine on the first misconduct

According to the current version of the law, the tax office is obliged to impose a fine on him for every single mistake of the taxpayer. From January 1, 2024, the tax office will no longer impose a fine if the taxpayer makes a mistake for the first time. This is the case, for example, when a taxpayer belatedly files a tax return, control statement or notification. However, for the second and subsequent misconduct, the tax administrator will already impose a fine.

Travel allowances and meal vouchers

Increase in subsistence allowance for domestic business trips

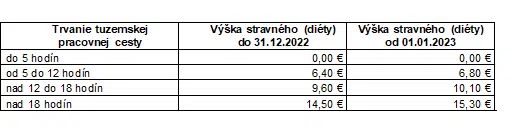

After the increase in the subsistence allowance for domestic business trips from September 1, 2022, domestic diets are again increased with effect from the New Year. The amount of the dietary allowance (diet) is increased as follows:

Increase in the value of gastronomic tickets

Along with the increase in the domestic meal allowance, the minimum value of meal vouchers is changing from the current 4.80 euros to 5.10 euros from the New Year, while meal vouchers will only be electronic, they will take the form of an electronic meal card.

For employers who provide employees with a financial contribution instead of meal vouchers, this contribution is increased from the current €2.64 to €2.81 from 1 January 2023.

Increase in wage surcharges

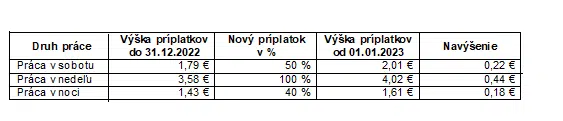

Until the end of 2022, wage supplements for weekend and night work are set at a fixed amount. From 1 January, wage supplements will be based on the minimum wage and will also be increased. The amount of wage supplements is increased as follows:

Social Insurance Act

Cancellation of the annual social insurance settlement

Just as the annual health insurance settlement has been in place for several years, the annual social insurance settlement was originally supposed to be introduced from 2022 onwards and later from 2023. Since, as expected, the state has failed to implement this settlement, the payment of social insurance will work as before.

This will be especially appreciated by novice sole traders, who will continue to be exempt from the obligation to pay social contributions for the first year.

Health Insurance Act

From the New Year, the minimum assessment basis of the employee is introduced. The minimum amount of health contributions will be based on the subsistence minimum, while in 2023 all employees will pay health contributions of at least 32.81 euros per month (393.82 euros per year).

The change will primarily affect low-employment employees (e.g. 1/8) and, since a manager is considered an employee for health insurance purposes, so are all managers of companies receiving low remuneration. Thus, under the new rules, employees and executives will no longer pay health contributions from a low-set monthly income, but will pay them at least 32.81 euros per month.

Employees and executives with low monthly incomes, who basically determine the amount of monthly remuneration themselves, should consider setting their monthly income. They should not only take into account the minimum health contributions, but also think about the minimum pension to which they will be entitled only after having worked for 30 years of the qualifying period. In order for their earned income to be counted towards their years of service, the income must be set at least at 24.1% of the average salary, which for 2022 amounts to about 320 euros per month (3,840 euros per year).

Other regulations

Increase in child benefit

From 1 January 2023, child benefit is increased from the current €30 to double. The first increased child benefit of 60 euros will be received by parents of dependent children in February, as these are paid monthly behind.

Abolition of licence fees

With effect from 1 July 2023, licence fees will be abolished. Thus, the public broadcaster RTVS will no longer be financed by citizens, but will be connected directly to the state budget.