Flexible packages

At TaxWise we charge many newly created s.r.o., and therefore we have customized our packages. These are designed so that small companies do not haveto pay too much for keeping accounts - unless they have only a few invoices, cash receipts or transactions in a bank account.

Benefits for accounting

- You only pay for what we actually charge.

- The package adapts to you every month.

- Possibility to negotiate a fixed flat rate.

Packages

The principle of flexible packages is that the invoiced amount is determined according to the accounting cases (items) actually posted for a given month. Thus, it is possible that without the need to sign an amendment to the contract, one month you will pay € 170 for bookkeeping, and the next only € 70. The minimum remuneration is set to take into account communication with the client and time spent on billing. Other packages mainly take into account only the time spent on posting documents.

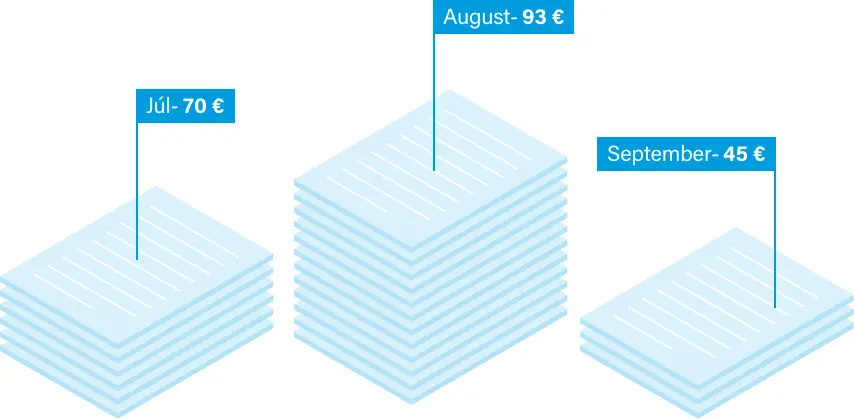

We currently offer our clients 3 packages of services for bookkeeping, starting from 70 €. Over 100 accounting items, we invoice 1.4 Euro for each additional accounting item.

Annual accounts

Due to delayed delivery of documents, we may charge additional accounting cases within the month already invoiced. These may be cases not containing VAT, but also accounting cases relating to and affecting VAT with the obligation to file an additional VAT return. This situation occurs most often at the beginning of the year, when closing accounts and drawing up financial statements for the previous calendar year, we additionally account for accounting cases until December. We invoice these accounting cases that have not been billed as additional accounting items together with the financial statements.

Tax consultancy, consultation and administrative services

Tax advice provided by tax advisors, consultations provided by senior accountants, partners and tax advisors, as well as administrative services provided by accountants and assistants are not included in monthly packages. We invoice them based on the hours actually worked, at an hourly rate according to the price list.

Examples of when these are paid and unpaid accounting and tax advice.

Flat-rate invoicing

Not every company is comfortable with flexible invoicing based on the number of accounting entries. There are clients who prefer the same invoicing every month. Fixed invoicing is preferred by clients because of a pre-planned cost budget or because of the setting up of a monthly standing order to pay our invoices, or for another reason. Even in this case, we can agree with the client individually and fulfill his request for invoicing a flat fee for keeping accounts and, if necessary, for other services.