Keeping of accounts, which will be adjusted monthly.

Bookkeeping

Accounting is not only a fulfillment of a legal obligation, but is also an excellent tool to keep track of your own business. Thanks to accounting, you can better assess and evaluate where your company is currently located. Based on accounting output and reporting, you can better determine the right direction and orientation for the future. We at Taxwise, as your strong and stable partner, strive to optimize your accounting costs also through gradual automation.

- accompanying the audit

- keeping of stock records

- communication with tax authorities

- keeping a book of receivables and liabilities

- preparation of documents and documents for archiving

- registering assets and drawing up depreciation plans

- preparation of reports for INTRASTAT, NBS and statistics

- preparation of internal accounting directives

- keeping a cash book in domestic and foreign currency

- inventory of accounts and financial statements

- passing problematic and unclear documents with the client

- correct assessment and posting of documents in the accounting program

- checking the formal accuracy of accounting documents and documents

- processing of the preliminary tax calculation before the end of the year

- processing and submission of VAT returns, control and recapitulative statements

Scope of accounting services:

- ongoing accounting

- checking accounting documents

- drawing up VAT returns

- ongoing accounting advice

- preparation of financial statements and tax returns

- accounting reporting

- drawing up the accounts of business trips

- processing of statistical returns

We are the accounting partner of 600 satisfied clients.

How does the collaboration work?

-

1

Reminder

Every month we remind you of the delivery of documents.

-

2

Download

You will deliver the documents in person, by post or by electronic means.

-

3

Check

We will check the formal accuracy of the documents.

-

4

Posting

We will post your documents as soon as possible.

-

5

Communication

We will communicate uncertainties about documents with you.

-

6

Risks

We will draw attention to any accounting and tax risks.

-

7

Advice

We will answer your accounting, tax and wage issues.

-

8

Reporting

We'll compile, review, file returns and reports.

-

9

reporting

We regularly send outs from your accounts.

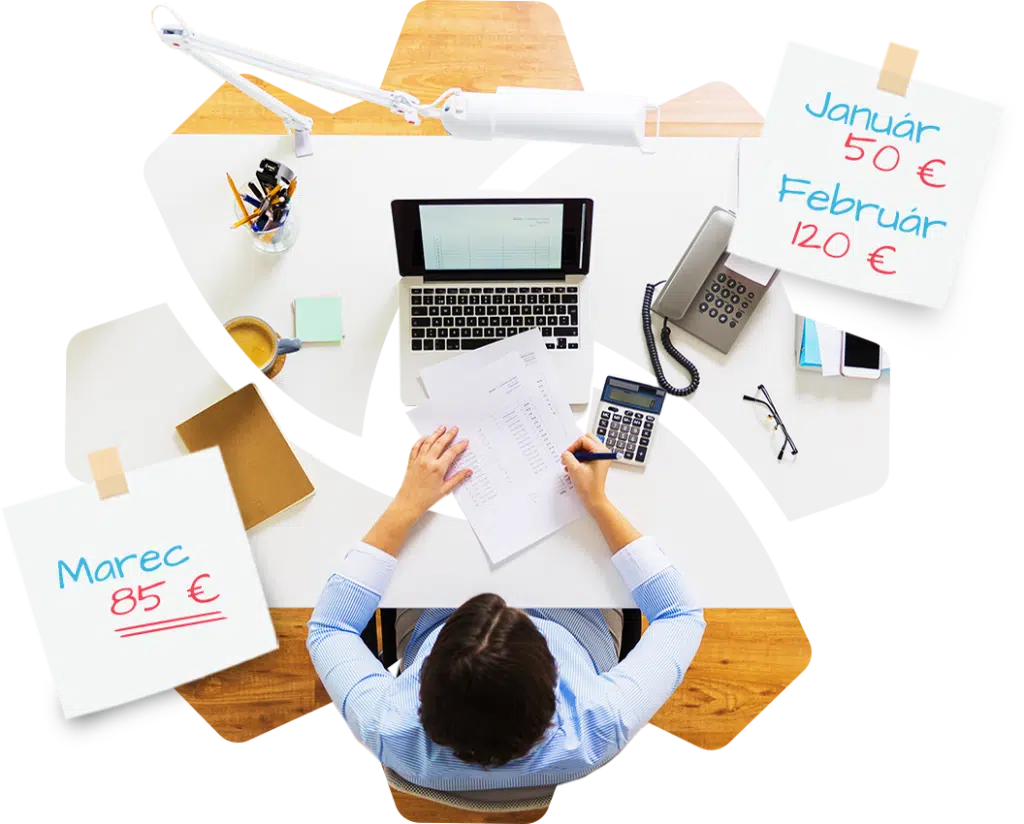

Flexible packages

At TaxWise we charge many newly created s.r.o., and therefore we have customized our packages. These are designed so that small companies do not haveto pay too much for keeping accounts - unless they have only a few invoices, cash receipts or transactions in a bank account.

Benefits for accounting

- You only pay for what we actually charge.

- The package adapts to you every month.

- Possibility to negotiate a fixed flat rate.

Price list of accounts

up to 40 accounting items

Monthlyup to 70 accounting items

Monthlyup to 100 accounting headings

Monthlymore than 100 accounting items

for each extra item- 10% discount on accounting

Service of documents by the 7th day of the month

We give our clients a bonus for early delivery of accounting documents in the amount of 10% (the discount refers to the remuneration for keeping accounts). The aim of the discount offered is not only to post documents as soon as possible, but also to process and file a VAT return before the 15th day of the month.

In order to qualify for the bonus, you must deliver a substantial part of your accounting documents to us within 7 days of the month and at the same time have all our invoices paid at that time. In the event that you fail to deliver any document on time, but you deliver it to us additionally, with the result that our intention of the discount offered will be fulfilled, you will not lose the discount.